Quick Summary: FinTech startups in Australia are continually seeking ways to move quickly, maintain compliance, and scale effectively. Monoova‘s integration services for FinTech startups offer an API-driven solution that automates payments, streamlines reconciliation, and ensures regulatory compliance. This blog explores how startups can leverage Monoova to streamline operations, deliver seamless real-time payments, and focus on growth while building a FinTech platform that is agile, reliable, and future-ready.

The success of any FinTech startup depends on three key aspects: speed, automation, and the simplicity of its service. However, most startups encounter a barrier when their payment infrastructure is unable to scale. The major pain points for FinTechs typically include manual reconciliation, slow settlement times, and compliance issues.

The urgency is real. The global real-time payments market, for instance, is projected to grow from USD 34.61 billion in 2024 to USD 284.49 billion by 2032. This reflects a surge in demand for instant, automated transactions. FinTech startups that can’t keep pace risk falling behind competitors who are already moving money faster and smarter.

This is where Monoova comes in. Founded in 2017, Monoova is an Australian payment automation platform offering API-driven tools to manage the entire payment lifecycle. For FinTech startups, lenders, and marketplaces, Monoova turns slow, fragmented processes into automated, scalable payment operations. With Monoova, you can reduce errors, streamline reconciliation, and focus on what matters most: growing your business.

In this guide, we’ll explore how Monoova integration services help FinTech startups orchestrate payments, automate workflows, and accelerate growth, step by step.

Why Monoova Integration Services for FinTech Startups are a Game Changer

As we already discussed, FinTech startups have a pyramid of operational challenges they need to climb, which includes –

- Slow and delayed settlements

- The pain and annoyance of manual reconciliation

- Having to deal with constant compliance headaches

Such inefficiencies don’t just slow down operations; they also limit or block potential growth. Monoova payment automation services are designed to address such pain points. You can automate the entire payment lifecycle right from collections to disbursements.

Monoova integration services for FinTech startups help them:

- Reduce manual errors

- Free up resources

- Pay more attention to their core expertise

For industries like Fintech in Wealth Management that require accuracy, compliance, and instant settlements, these automation capabilities gain more value.

Payment Orchestration for FinTech Startups

What is Payment Orchestration?

Payment orchestration is the strategic management and streamlined flow of funds across different payment methods and providers. Think of it as a conductor for your payments, where its role is to ensure all transactions move through the most efficient channel, irrespective of their origin or destination.

Why is it important for the payment gateway to support multiple payment methods?

The global market has multiple service providers for almost everything, and what Australians and global customers appreciate most is the freedom of choice. A payment gateway API integration that supports multiple payment methods, be it traditional credit cards to modern digital wallets and bank transfers, will have more success than those that simply adapt to the latest technology or stay obsolete with age-old methods.

How Monoova Supports Efficient Payment Orchestration?

Monoova offers a single, unified payment platform that supports various payment flows, including real-time settlements, multi-currency support, and automated reconciliation. What this translates to for FinTech startups is you don’t have to worry about cash flow, you’ll make way fewer manual errors, and you will get a much leaner, automated operations team.

Monoova’s API-Driven Payment Solutions for Agile Startups

Agility is crucial for a successful FinTech startup in Australia. You need to build, iterate, and launch products at an impressive pace, and you can’t let your payment infrastructure be a roadblock. This is why Monoova offers API-driven payment solutions.

What Business Challenges does FinTech face in Offering the New Service?

| Challenges | Description |

| Delayed Settlements | Funds take time to clear, impacting cash flow and slowing down operations. |

| Manual Reconciliation | The tedious and error-prone process of manually matching payments to accounts. |

| Compliance Headaches | Navigating complex regulatory requirements and ensuring data security. |

Why is an API-First Approach Beneficial for FinTech Startups?

Taking an API-first approach for payment integration means the entire platform (Monoova) is designed around a single, robust, and developer-friendly API. It is not a bolt-on solution; it is the engine room. This comes in handy for SaaS platforms, marketplaces, and lending services that need to constantly fine-tune their product. These are some key values that make Monoova an ideal Fintech payment solutions platform:

- Easy Integration: Connect to a single, unified API and access all Monoova’s core services. No need for complex development, just launch, iterate, and deploy. Saves time and resources, which is crucial when competing against the big players.

- Developer-First Tools: Monoova offers comprehensive and thorough API documentation, along with a dedicated sandbox environment. With the right API integration services provider, you can build, test, and validate every function risk-free.

- Modular and Flexible: Monoova solves the age-old problem faced by FinTech startups. It accommodates and scales as you grow. Whether you are building a lean MVP or a full-scale payment processing for FinTech startups, you get to pick and choose the services you need. It avoids the “bells and whistles” you won’t need.

A mobile app development company can leverage this API-first ecosystem to integrate payment features seamlessly into mobile banking, lending, and wealth management apps. Businesses looking to hire mobile app developers can also gain a competitive edge by ensuring these integrations are future-ready.

Monoova Comparison with Top Australian FinTech Platforms

As a FinTech startup, you want to be sure of the payment platform you choose for your business. It is a strategic move that can define the trajectory of your business. The Australian FinTech landscape is home to some of the best payment solutions for fintech like Airwallex, Zeller, Judo Bank, and Zai. They all have their strengths and specialized focus areas.

So, how does Monoova stack up against these established giants in terms of the startup essentials: speed, automation, and compliance?

| FinTech Platform | Best Suitable For | Description |

| Monoova | Startups, lenders, marketplaces | API-first, real-time payments, automated reconciliation, scalable, compliance-ready |

| Airwallex | Global enterprises | Cross-border transactions, multi-currency support, strong compliance |

| Zeller | Small businesses & merchants | Quick onboarding, instant reporting, automated payments, AU compliance |

| Judo Bank | SMEs | Lending, deposits, fast funds access, strong regulatory compliance |

| Zai | Mid-market & enterprise | Payment orchestration, cross-border payments, fraud management, unified API |

- Monoova: An API-first Australian payment automation platform designed for FinTech startups. It streamlines collections, disbursements, and reconciliation while ensuring compliance. Offers real-time payments and a modular, scalable infrastructure.

- Airwallex: A global payments platform that specializes in cross-border transactions and multi-currency support. Strong automation for international settlements, but with a more enterprise-focused approach. Provides integrated compliance and risk management features.

- Zeller: Focused on fast, modern banking solutions for small businesses and merchants. Offers quick onboarding and instant transaction reporting, with automation in payments and reconciliation. Regulatory compliance is built in for Australian operations.

- Judo Bank: A challenger bank catering to SMEs with lending and deposit solutions. Fast access to funds and digital account management, though API integration is less startup-focused. Strong regulatory compliance and financial security.

- Zai: An Australian FinTech platform formed from the merger of Assembly Payments and CurrencyFair. Offers payment orchestration, cross-border payments, fraud management, and reconciliation through a unified API. Designed for automation, scalability, and compliance for mid-market and enterprise businesses.

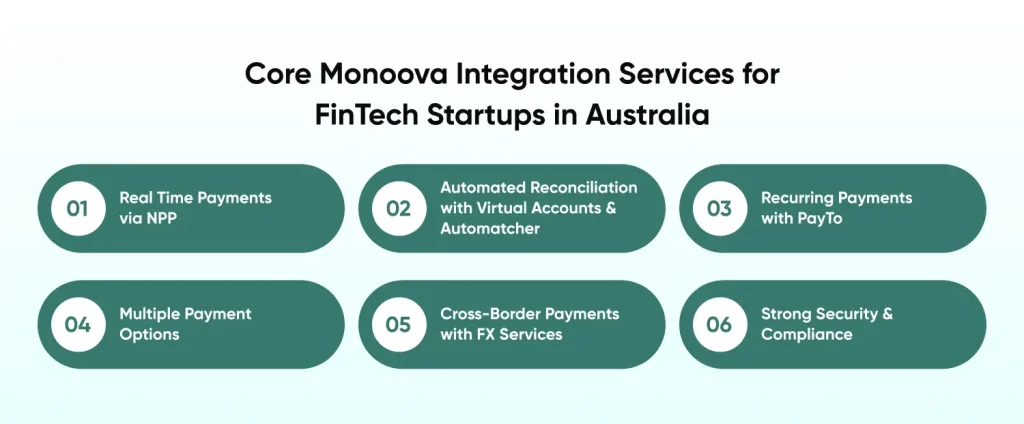

Core Monoova Integration Services for FinTech Startups in Australia

Real Time Payments via NPP

Monoova provides access to the New Payments Platform (NPP) for instant money transfers. Simply collect all payments using PayID and send them out with Osko in seconds. Instarem, a global remittance platform, utilized Monoova to make over 90% of its payments instant, which previously took a day or two.

Automated Reconciliation with Virtual Accounts and Automatcher

Monoova provides a service called “Automatcher”. It gives each customer a unique PayID account number. When a payment arrives, it’s instantly matched to that person. No riffling through the tedious manual work. Most online marketplaces use this feature to hold money safely until a sale is confirmed.

Recurring Payments with PayTo

As a FinTech startup in Australia, you are bound to have a need for setting up regular payments. Monoova integration services offer a modern approach to handling recurring payments with PayTo. It works better than direct debits as customers can approve payments in their banking app. This provides more control to the customer and they can stop failed payments.

Multiple Payment Options

Monoova provides access to all important Australian payment methods with a single API. This includes Direct Entry (BECS), BPAY for bill payments, and RTGS for large transactions. You can open gates for all customers, irrespective of their preferred payment method.

Cross-Border Payments with FX Services

If you are a global business, Monoova can help you set up your international payments with ease, provide you with competitive rates, and even achieve same-day settlements. All of this is made possible with their dedicated Foreign Exchange service.

Strong Security & Compliance

Monoova provides a secure platform that adheres to top industry standards, including SOC2 Type II and PCI-DSS. The platform features include Confirmation of Payee, which verifies account details before sending money, and numerous built-in anti-fraud tools to protect both your business and customers.

Monoova API Integration for FinTech: Step-by-Step Approach

Once you know what Monoova can do, the second step is to implement Monoova in your FinTech platform. Smooth and properly planned API integration helps enhance payment cycles, reconciliations, and effective customer interactions. Startups can automate processes, eliminate human errors, and have full control over their financial processes. After going through a careful Monoova API Integration for FinTech: Step-by-Step Guide, one can easily chart these processes from sandbox testing to live deployment so that startups have their payment operations up and running smoothly from day one.

How Startups Benefit from Monoova Integration Services

- FinTech growth with Monoova Automation: Monoova’s platform provides the tools to scale payment infrastructure without a large finance team. By automating flows, startups can handle increased transaction volumes as they grow.

- Improved Cash Flow and Liquidity: Monoova provides startups with access to real-time payments, ensuring funds are processed instantly. This eliminates delays and provides an up-to-the-minute view of finances.

- Enhanced Customer Experience: Monoova integration allows startups to offer a more seamless payment experience. Features like PayID provide a simple way to pay, and the speed of transactions gives instant confirmation. Startups that hire mobile app developers familiar with Monoova APIs can deliver smoother mobile-first experiences, ensuring customers enjoy instant payments and secure financial transactions.

- Reduced Operational Complexity: Monoova’s “Automatcher” service eliminates the need for manual reconciliation. Such operational automation frees up valuable time and resources. This allows your employees to get more time to focus on strategic tasks.

Why is CMARIX the Best Monoova Integration Company?

To take advantage of Monoova integration services, you need to have the right partner by your side. CMARIX is a leading provider of API integration services, with considerable experience working with FinTech teams and platforms, including Monoova, QuickBooks, and other prominent platforms. We focus on delivering real, tangible value from the very beginning.

- Proven FinTech Expertise: We aren’t just developers; we’re FinTech specialists with a deep understanding of payments, security, and compliance. With a proven and credible work portfolio in the financial sector, we will build your solution right the first time.

- API-First Approach: Our expertise in API-first development ensures seamless connectivity. This approach means your solution is built for interoperability from the start, allowing for smooth data flow and easy integration with other systems.

- End-to-End Support: We provide full-cycle support, from initial strategy and planning to development, testing, and deployment. This end-to-end service means you have a reliable partner every step of the way, giving you peace of mind.

- Customized for Startups: We know every startup is unique. We can create and build a FinTech app from scratch or extend its features, and we provide tailored AI-driven software development services to meet your specific business needs and goals. Whether you’re building an MVP or a full-scale platform. Our solutions are designed to be flexible and to grow with you.

- Agile & Transparent Delivery: Our agile methodology ensures fast, efficient delivery with complete transparency. We use a SCRUM-based process with regular updates and communication, so you always know the project’s status and can provide feedback.

- Security & Compliance Focus: Security is of utmost importance for us. We develop your solution with strong protocols and compliance with industry standards such as SOC 2 Type II and PCI-DSS, which makes your system secure from threats and completely compliant.

- Ongoing Support & Maintenance: Our ongoing maintenance and support services ensure your system remains up to date, secure, and operates optimally. This ensures long-term reliability and performance.

FAQs for Monoova Integration Services

What Is Monoova and How Does It Help Fintech Startups?

Monoova is an Australian B2B payment platform that helps businesses automate their payment operations. It provides an API-driven solution that streamlines the entire money lifecycle, from collections to disbursements, helping FinTechs operate faster and more efficiently.

Why Should I Integrate Monoova Into My Fintech App?

Integrating Monoova allows you to automate core payment functions like reconciliation and fund transfers. This saves time, reduces manual errors, and provides a better user experience with real-time payments, which is essential for scaling a FinTech app.

Can Monoova Integration Work With My Existing System?

Yes, Monoova is designed to integrate seamlessly with your existing systems and infrastructure. Its robust API can connect with your platforms, ERP, and reporting systems to automate payment workflows without requiring you to rebuild your technology stack.

How Much Does Monoova Integration Cost?

The specific cost of Monoova integration depends on the complexity of your project and the services you require. It typically involves transaction-based fees and may include additional fixed costs; however, it generally leads to reduced costs by automating manual work and improving efficiency.

What Are the Benefits of Using Monoova?

The main benefits of using Monoova are faster, more reliable payments and automated reconciliation, which frees up valuable time for your team. It also provides access to multiple Australian payment rails, enhances security, and improves cash flow, allowing you to focus on business growth.