In this digital age, to ensure efficient & secure verification of identity is essential. It’s vital for the digital platforms and financial services. The practice known as Know Your Customer, or KYC, isn’t only the regulatory requirement. It is also the fundamental aspect to build trust and to safeguard against fraud. With advanced tech advent, the KYC process has evolved.

It offers businesses streamlined and robust solutions. FrankieOne KYC integration is one such comprehensive solution. It is a powerful tool that’s designed to simplify & enhance mobile applications’ KYC verification. With FrankieOne, a lot is possible today.

Overview of KYC Verification

Importance of KYC Verification within Financial Services & Digital Platforms

KYC is the essential process within Digital platforms and financial services. It helps to verify the client’s identity. The verification even helps in prevention of money laundering, fraud, and other illicit activities. It does so by ensuring entities that engage in financial transactions are ones that claim to be.

KYC’s importance cannot be overstated. It is because it builds the foundation of trust between clients and businesses. It also promotes a secure environment where financial transactions gets conducted confidently.

Necessity for Secure and Efficient Identity Verification

With digitization, it’s important to have efficient and secure identity verification. As there’s a surge in digital banking & online transactions, there’s a high chance of fraud. It’s done via identity theft and other means.

KYC verification mobile app helps with the mitigation of such risks. They do so by offering the robust methods to verify identity accurately and quickly. This enhances security. It improves the customer experience with a streamlined on-boarding process. It makes it easy for the legitimate users to have access to services.

Introduction to FrankiOne

Brief Introduction to FrankieOne as a Comprehensive KYC Solution Provider

FrankieOne API integration services is a comprehensive KYC solution provider. It offers a robust API that’s designed to enhance and simplify identity verification.

As a premier player, FrankieOne KYC SDK for mobile apps integrates verification techs. It also integrates data sources for delivering the all-encompassing solution. Such expertise, it ensures that businesses can comply to regulatory requirements. They can do so while maintaining a seamless experience for users. With the leveraging of cutting-edge tech, FrankieOne ensures identity verification is secure, user-friendly & swift.

FrankieOne’s Capabilities & Expertise in the Field

FrankieOne in the KYC landscape stands out. It’s due to its deep expertise, and it’s extensive capabilities. The platform provides unified KYC API integration, which connects to varied data sources. It then offers a comprehensive view of the identity of each customer. Such integration, it supports varied verification methods. Some of such methods are biometric checks, real-time data validation & document scanning.

With a focus on security and innovation, the FrankieOne KYC integration updates continuously. With it, the solutions adapt to the evolving regulatory changes and threats. It ensures that businesses to stay ahead of the curve.

Benefits & Process of Integrating FrankieOne Integration in Mobile Apps for KYC Verification

The blog’s purpose here is the elucidation of processes & benefits of using FrankieOne for KYC. With the integration of mobile app KYC solutions API, businesses could,

- Enhance KYC Procedures

- Ensure identity verification remains efficient & secure.

The integration protects against fraud. It also streamlines the user on-boarding experience. It makes it more convenient and faster for the customers to access services.

Integrating FrankieOne in mobile apps gives a powerful approach to KYC Verification. It also offers a better approach to efficiency as well as user-friendliness. Whether you are a financial institution or a digital platform, FrankieOne is one for you. Digital identity verification, it will ensure the enhancement of customer trust & compliance.

Importance of KYC Verification

What is KYC?

It is the process via which businesses verify the identity of the clients. It helps prevent illegal activities like fraud, money laundering and more.

Definition and Fundamental Aspects of KYC

The verification is important for the prevention of illegal activities. Best KYC solutions for mobile apps include the collection & validation of identity forms. It can be either proof of address, IDs issued by a government or anything with personal info.

Regulatory Requirements for Businesses in Varied Sectors

KYC’s regulatory requirements vary across varied sectors. It is but stringent within the financial industry. Institutions like investment firms & banks are mandated by the laws to implement KYC procedures. Such regulators need institutions to gather customer information. They also need them to track transactions for the suspicious activities. If needed, at times, even reporting the anomalies to relevant authorities is essential too.

In the case of healthcare, the KYC process brings stringent security measures. Herein, the need is to protect the patient info. As for the telecommunication & real estate sector, the KYC is to prevent fraud. It’s also to ensure compliance with the local news. Further, in either case, KYC verification has a pivotal role in maintaining regulatory compliance. It also safeguards against any illegal activities.

What are the Challenges in KYC Integration?

Common Issues Businesses Face with Traditional KYC Process

Some common KYC issues as per traditional mobile app development company are,

- Time Consuming: Manual verification is full of varied stages. It takes days or even weeks. Any prolonged timeframes cause customer dissatisfaction and loss of business.

- Cost: There’s a high expense for staffing, maintenance and training of the team. Financial burdens from errors/fraudulent activities can also happen with ineffective KYC measures.

- Complexity: There are challenges to keeping up with evolving & diverse regulatory needs across varied regions. It also occurs to integrate the KYC in the existing system. It can lead to operational inefficiency and more.

Impact on User Experience & Operational Efficiency

User Experience

The verification processes that are lengthy can cause frustration for customers. It can cause high abandonment rates with onboarding. Any repeated requests for the documentation cause irritation in users. It’s specifically where they offer the same information many times.

Operational Efficiency

Resources and time on manual KYC divert attention from the core activities. Also, inefficient procedures slow workflow and reduce productivity. Even an increased high error rate within manual verification can increase rework. It can also increase compliance risks.

About FrankieOne

FrankieOne is the leading mobile app KYC solutions provider. It offers a comprehensive API that’s designed for streamlining and enhancing verification. FrankieOne helps to simplify compliance while improving user experience. It is a trusted partner for businesses looking for financial app development.

FrankieOne API offers a suite of solutions & services like identity verification and fraud detection. Leveraging advanced tech like ML & AI, it ensures businesses perform accurate KYC.

Company Background & Mission

FrankieOne is the forward-thing tech company. It specializes in fraud prevention and identity verification. It was founded to simplify risk management and compliance. In this way, it transforms the ways in which businesses tackle the identity challenges. The mission here is to create a safe world with secure, seamless & efficient ID verification.

Overview of Services & Solutions by FrankieOne

FrankieOne offers comprehensive services suite to ensure,

- Real-time identity verification with biometric tech & document authentication.

- AI-driven fraud detection. It analyzes patterns to identify suspicious activities.

- Use compliance management tools to help businesses in navigating the landscape of complex regulations.

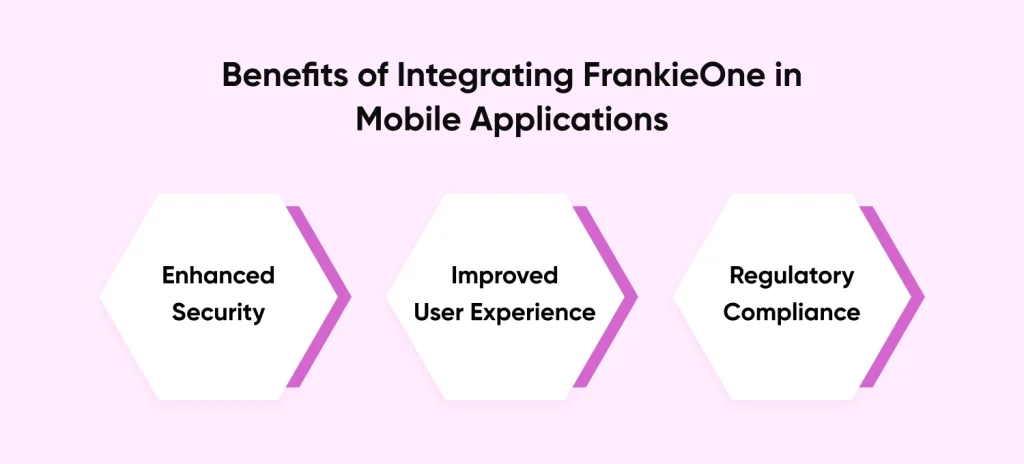

Benefits of Integrating FrankieOne in Mobile Applications

- Enhanced Security: Enhanced security with state-of-the-art measures like secure data storage and encryption.

- Improved user experience: Improved User Experience with a seamless interface. It reduces the drop-off rates at onboarding.

- Regulatory Compliance: Regulatory compliance with the global standards like CTF and AML regulations. It allows businesses to operate in legal frameworks.

Technical Integration Process

Detailed Steps to Integrate FrankieOne’s KYC Solutions in Mobile App

A step-by-step guide to help with payment gateway API integration is below.

- Sign up on the FrankieOne platform. Obtain the API keys. It’s essential to authenticate requests to FrankieOne.

- Install SDK after download. It will give the necessary libraries and tools to interact with API.

- Configure SDK with API keys and other settings. It includes adding SDK to the project and initializing it with credentials.

- Implement KYC workflow in the mobile app. Like integration of API endpoints for document upload or any other KYC-related tasks.

- Test integration to ensure KYC works as expected. It also verifies API responses to ensure they are accurate and the user experience is smooth.

- After getting satisfied with the integration, ensure to deploy the app to a live environment. Then, monitor API usage and the performance. It will help with enhancing mobile app security with KYC integration. It will also ensure a seamless experience for users.

Tips for a Smooth and Efficient Integration Process

- Read API documentation to understand endpoints, authentication processes, request methods, etc.

- Ensure to have the needed credentials & permissions before the coding.

- Employ the tools like Postman to test API responses and requests.

- An experiment in the sandbox environment for understanding behaviour, without impact live data.

- Give attention to the error messages. It will help you gain insight and troubleshoot.

- Store the API keys & credentials via environment variables or the secure vaults.

Developer Resources & Support

Resources Available to Developers

FrankieOne gives a wealth of resources. It’s meant to assist the developers with integration. It includes,

- Comprehensive documentation

- Tutorials

- Support forums are available to see help from the community for anything, including cloud migration.

- The technical support team of FrankieOne.

Contact Information for Technical Support

For the technical issues/inquiries, the support team of FrankieOne can be contacted. The support team offers professional & prompt help to ensure that integration succeeds.

Conclusion

FrankieOne KYC Integration for the KYC integration within mobile apps offers many benefits. It includes improved user experience, regulatory compliance, and more. By leveraging the advanced expertise & tech of FrankieOne, businesses can do better. They can streamline the KYC processes & offer a smooth experience for onboarding of customers.

If you do not need any help, hire mobile app developers today. Set out on the journey to do better and get great results.

Frequently Asked Questions

How Can I Integrate KYC Verification within Mobile Apps?

KYC verification integration within mobile apps includes the use of a comprehensive solution (FrankieOne API). Use the information provided above to integrate the API into a mobile app.

How do you integrate FrankieOne with mobile applications?

FrankieOne API integration with the mobile apps via SDK offers the necessary libraries & tools. Developers can easily configure SDK with API keys. They can even implement KYC workflow in the apps.

What Benefits Are There to Using FrankieOne for Mobile Apps’ Kyc Verification?

The benefits are- improved user experience, regulatory compliance and enhanced security. API offers an efficient and seamless solution for identity verification. It also reduces the cost and time related to traditional KYC processes.

Is the Frankieone Integration Process Complicated?

No, the process of integration is straightforward. FrankieOne offers comprehensive documentation & also resources for assisting developers. It thereby ensures efficient and smoother integrations.