Marketsmedia predicts that in the next five years, the use of AI in the banking industry will reach $300 billion with more than 80% of the banks implementing this technology. AI is transforming this industry by automating the decision-making process for users and bank employees. AI is revolutionizing client interaction through personalized experiences, advanced risk management, and increasing productivity.

This blog talks about the practical use cases of AI and machine learning in banking. With this, we will also discuss the steps to follow to successfully implement AI and examples of artificial intelligence in banking.

Why AI in Banking and Financial Services is Important?

Over the decade, the banking industry has advanced with the new mobile banking trends and technologies. Its rapid change in retail, telecommunication, and IT offers e-banking, mobile banking, and money transfer services has helped the transformation of the industry. Listed below are a few banking and finance applications:

- Automation of Customer Service,

- Fraud Detection, and Security

- Personalized Suggestions

- Compliance and Risk Management

- Operational efficiency

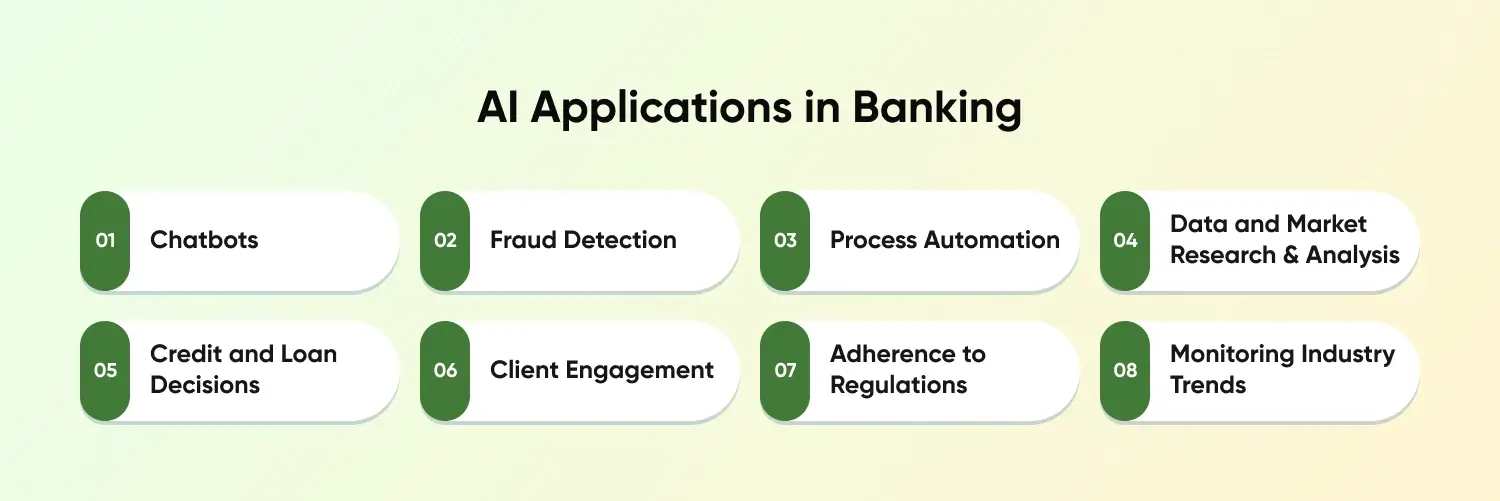

AI Applications in Banking

Today, everybody is using AI and relies on AI in banking. And so, the banking sector has already implemented this technology in their services. With these examples, you can build a Neobank app like for your banking business. Below are some of the AI use cases in the banking sector:

1. Chatbots

The most and best instance of AI in banking use cases is chatbots. They also continue to learn about the usage habits of a specific customer. It facilitates their effective understanding of the user’s requirements. Banks might ensure that the customers who access their apps can also incorporate chatbots int he application. Furthermore, chatbots can provide customized customer care by analyzing user behavior. Minimize effort spent on email and other channels, and suggest appropriate financial services.

2. Fraud Detection

People use apps or online accounts daily for several digital tasks, such as bill payments, cash withdrawals, cheque deposits, and more. The financial sector must therefore raise the quantity of fraud it discovers.

This is where banking artificial intelligence becomes useful. Banks can detect fraudulent activity, monitor system vulnerabilities, reduce risks, and enhance the general security of online banking with the use of AI and machine learning. AI systems assist in locating and stopping any nefarious activity in the financial industry. Artificial intelligence (AI) finds abnormalities that point to possible fraud problems by examining vast volumes of transaction data and identifying trends.

3. Process Automation

AI is the key factor in the banking industry automation for routine processes. This increases productivity and reduces costs in data input, document processing, and client onboarding. With AI technologies like RPA and NLP, this frees up human effort and can concentrate on other valuable tasks.

Automated loan application processing and underwriting, intelligent document processing and data extraction, and automated account opening and KYC (Know Your Customer) procedures are a few examples of successful process automation at different banks.

Banks can improve turnaround times, lower operating costs, and minimize errors by automating these procedures, which will ultimately improve the general customer experience.

4. Data and Market Research & Analysis

Every day, banking and financial organizations log millions of transactions. Employees find it daunting to collect and register the massive amount of information that is generated. It becomes impossible to organize and capture such a large volume of data accurately.

In these kinds of situations, creative AI and banking software development companies aid in effective data collection and analysis. Thus, the entire user experience is enhanced. Additionally, the data can be utilized to determine creditworthiness or identify fraud.

Artificial intelligence (AI)-powered market analysis improves investment insights by offering precise, fast, and thorough data. A data-driven approach to investing is ensure by the use of AI in market analysis, which can enhance portfolio performance and lower exposure to market volatility.

5. Credit and Loan Decisions

AI-based technologies are being used by banks to make safer, more profitable, and well-informed lending and credit choices. To assess a person’s or business’s creditworthiness, many banks are still far too limited in their use of credit history, credit scores, and customer references. It is undeniable, nonetheless, that these credit reporting systems frequently contain a lot of mistakes, exclude actual transaction data, and incorrectly categorize creditors.

Customers with little credit history can have their creditworthiness assessed by an AI-based loan and credit system by analyzing their behavior and trends. Additionally, the system alerts banks to certain actions that can raise the likelihood of a default. To put it briefly, these technologies are significantly influencing how consumer credit will develop in the future.

6. Client Engagement

Consumers are always searching for more convenience and better experiences. For instance, the fact that users could still use ATMs to deposit and take money during bank holidays contributed to their success.

More innovation has only been spurred by this degree of convenience. Users use smartphones to operate bank accounts from anywhere and anytime. With the help of mobile app development services, AI and machine learning in banking improves user experience.

AI technology minimizes errors and speeds up the process of recording Know Your Customer (KYC) information. Furthermore, timely releases of new goods and financial offers are made.

AI is used to automate eligibility for situations like asking for a personal loan or credit, saving customers the trouble of having to go through the entire process by hand. AI-based software also speeds up approval processes for services like loan disbursement. AI in banking customer care also aids in the precise collection of customer data necessary for error-free account setup and a seamless customer experience.

7. Adherence to Regulations

One of the areas of the global economy that is most strictly regulate is banking. By exploiting their regulatory power, governments make sure that bank clients aren’t exploiting their institutions to commit financial crimes and that banks have manageable risk profiles to prevent significant defaults.

To handle these issues, banks often have an internal compliance staff; nevertheless, manual techniques are much more labor-intensive and expensive. Additionally, banks must continuously upgrade their workflows and processes to comply with the constantly changing compliance regulations.

Deep learning and natural language processing (NLP) are used in banking AI and ML to interpret new regulatory requirements for financial organizations and enhance their decision-making. Even though compliance cannot be replaced by AI in the banking industry.

8. Monitoring Industry Trends

In the financial service industry, AI/ML enables to process huge data that help in predicting current market trends. Sophisticated machine learning methods aid in assessing market mood and making investment recommendations.

AI banking solutions can also advise when it’s ideal to buy equities and flag potential dangers. This cutting-edge technology facilitates convenient trading for banks and their clients and helps expedite decision-making due to its high data processing capability.

Strategies to Integrate the Application of AI in Banking

Create an AI governance framework. Ethical application of AI, accountability, and transparency are all ensured by effective AI governance. Avenga works with banks to design oversight procedures, data privacy policies, and governance frameworks. We adapt governance frameworks to meet the specific needs of your company as well as industry standards and legal obligations. Our professionals help you with the creation of policies, risk analysis, and compliance.

Choose AI application development services that have an impact. Not every AI application has the same advantages. Avenga concentrates on finding high-impact use cases that tackle business problems head-on. We carry out comprehensive evaluations to identify domains in which artificial intelligence can yield benefits, such as streamlining loan approval procedures, augmenting consumer satisfaction, or forecasting market patterns.

Create a genuine AI ecosystem. Avenga connects data pipelines, models, and business processes with an emphasis on ecosystem thinking. We facilitate departmental collaboration by smoothly integrating AI into current workflows. Our all-encompassing strategy guarantees long-term success beyond specific initiatives.

Use adaptable cloud computing technologies. Cloud computing platforms provide cost-effectiveness, scalability, and agility. Avenga assists banks in selecting the ideal cloud architecture and provider. We evaluate your infrastructure requirements taking compliance, security, and data volume into account. Our cloud specialists provide solutions that fit the requirements and growth trajectory of your AI project.

Analyse experimental AI initiatives. Before a large-scale implementation, pilots verify AI principles. Avenga prioritizes rapid feedback loops and iterative learning. We help you with the planning, gathering, and analyzing of data for pilot projects. Our priorities are ongoing development and practical insights.

Create a center for AI integration. AI models with silos reduce effectiveness. Avenga creates hubs for integration that link various systems and provide smooth data transfer. Strong middleware layers are built by our integration specialists to guarantee seamless communication between AI components and older systems. The improved operating efficiency is the end outcome.

These steps give banks a framework for adopting AI strategically and guarantee that the technology is not only applied safely but also in line with the bank’s expansion and innovation objectives.

AI and the Future of Banking

Digital technology is having an impact on almost every industry and is also altering how businesses operate. Every industry is currently assessing its options and implementing strategies to prosper in this highly technologically advanced setting.

These days, every country is moving towards digitalization, which explains why the customer base of the banking sector is growing. The topic that needs to be addressed right now is how the banking sector can assist an increasing number of customers without increasing labor costs. Industries struggle to satisfy the unique needs of every customer. Consumers of today have very high expectations. In today’s technologically advanced world, customers want businesses in the banking sector to provide a happy and stress-free client experience.

Conclusion

AI can completely transform the banking industry by improving client experience, cutting down on errors, and streamlining procedures. Thus, to provide clients with cutting-edge experiences and top-notch services, all banking institutions need to invest in AI solutions.

As a top provider of banking software development services and banking AI services, CMARIX collaborates with banks and other financial institutions to create unique AI and ML-based models that increase income, lower expenses, and reduce risk across many departments.

Because of their expertise in artificial intelligence and understanding of the unique issues facing the banking sector, our IT professionals can help you leverage AI to bring about revolutionary improvements. Hire dedicated developers with CMARIX to assist you in developing AI-powered solutions that boost client satisfaction, automate processes, and improve risk management.

Frequently Asked Questions

How Is AI Used in the Banking Sector?

AI for banking streamlines operations to improve fraud, reduce costs, streamline operations, chatbot support, forecast market trends, etc. Due to the integration of AI, we can witness a substantial improvement in productivity, a decrease in expenses, and more personalized services.

How Does AI Help in Banking Risk Management?

Algorithms for artificial intelligence (AI) detect fraudulent activities by utilizing transactional data and customer behavior patterns. AI tracks transactions and generates data automatically, assisting banks in maintaining regulatory compliance. To determine the probability of defaults and market volatility, artificial intelligence develops risk models and does predictive analytics.

How Is AI Impacting the Banking Industry?

The banking industry makes value out of the technology to increase customers and enhance their user experience. Data entry, fraud detection, and other repetitive and routine operations are effectively automated by AI. This results in lower labor expenses and increased operational efficiency.