As part of its 2030 strategy, Saudi Arabia is among the Middle East’s fastest-developing nations. The e-payments sector is expected to achieve a total transaction value of US$48.90 billion last year. Businesses need a reliable and secure Saudi payment gateway API integration in this booming industry.

One of the biggest economies in the Middle East is found in the region around Saudi Arabia. Due to the country’s sophisticated population’s adoption of contemporary e-shopping, the retail sector is prosperous. Consumer trust in online channels is growing, strengthening user trust and hastening the evergreen adoption of online payments and eCommerce.

A key component of the digital payment spectrum is payment gateways. Include the recently enacted laws and the reliable digital infrastructure.

How to Choose the Best Online Payment Gateway?

How to select the best online payment gateway for your clients and store is a commonly asked question when discussing payment gateways. Making a poor choice for an online payment gateway will cost you money, time, and clients. You should consider the following factors while selecting the online payment gateway for your store and hire payment gateway developers to create a robust integrated app for your online eCommerce business:

Target Market

Selecting the best online payment gateway in Saudi Arabia will be simpler for you if you have clearly defined your online store’s target market. For example, geolocation enables you to confirm that the payment gateway functions within the desired nation. However, the likelihood of your clients understanding electronic currencies is low if they are 50 or older.

As a result, you want to avoid using online payment gateways that accept solely virtual money. Next, we advise you to select an online payment gateway that accepts payments forwarded upon receipt.

Cost and Expenses

In addition to the monthly fees and fees associated with each payment made through the portal, one must also consider the overall cost of the online payment gateway in Saudi Arabia. The majority of online payment gateways charge 2.9% plus 30 cents for each transaction. Make sure to look for payment gateways that offer services for specific monthly costs and minimal transaction fees if your company primarily handles high-value transactions.

Security

Your online payment gateway’s security needs to be your first concern when it comes to accepting online payments. Make sure the portal you select is PCI DSS Level 1 compatible. It ensures the confidentiality and security of your private financial data for both you and your clients.

Supporting Several Currencies

You must ensure that your online payment gateway can process payments from many nations and in multiple currencies if you are conducting business abroad. Encouraging your clients to pay using their currency is crucial. You must verify the exact amount of fees associated with transacting in foreign currencies.

Types of Credit Cards Allowed

Visa, MasterCard, and American Express are the credit card brands most people use. The payments mostly accept all of the given types of cards of online payments. On the other hand, you must confirm that your payment gateway accepts the card if your clients typically pay you with different kinds of cards.

Market Integration

This term refers to the range of choices that you, as an internet business, have, particularly about the market conditions that your enterprise may encounter. Assume that a local payment gateway is your partner. If so, they can offer you advice on national and local laws as well as assist you in integrating your business platform with them. But, if you choose a worldwide brand, you may still have this benefit in addition to a few more choices that will greatly improve your customer experience and integrations.

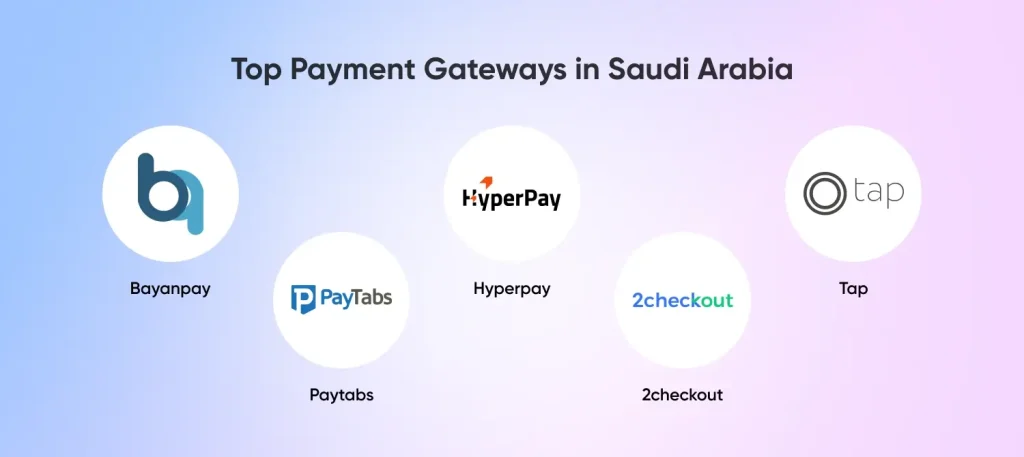

Top Payment Gateways in Saudi Arabia

One of the most important things when launching an internet business is selecting the finest payment gateway and to integrate Saudi Arabian payment methods. A software program known as a payment gateway makes it possible to process payments for transactions made online. Serving as a mediator between the client and the company, it guarantees a simple, safe, and speedy payment process.

1. Paytabs

PayTabs is another payment gateway service provider that works with start-ups and small enterprises in the UAE and the surrounding area. These payment gateway integration services deliver safe payment processing and PCI DSS compliance with a dependable payment gateway solution. They accept several payment options, such as credit and debit cards, digital wallets, and bank transfers. PayTabs provides user-friendly, simplified e-commerce platform plugins that provide a seamless connection with the majority of popular systems. PayTabs offers no initial expenses and a fair price structure.

Why is it one of Saudi Arabia’s most reliable payment gateways?

- It provides services in more than 160 currencies.

- There are no maintenance fees and setup expenditures of just $400.

- Less than a day is needed for its simple setup.

- Each transaction on Paytabs is charged 2.7% + $0.27.

- It has several integration options (API, plugins).

- The app is responsive to mobile devices.

2. Tap

Since its founding in 2014, Tap has developed into a well-known payment technology provider in the Middle East and North Africa (MENA) area. It provides services to over 50,000 companies, startups, and SMEs in several areas.

In Saudi Arabia, Tap payment gateway API integration is one of the top online payment gateways, providing businesses with a safe and easy way to handle payments. Credit cards, debit cards, and regional payment options including Mada, SADAD, and STC Pay are just a few of the payment methods that the platform accepts. Additionally, Tap provides sophisticated security measures to safeguard companies and their clients, like fraud prevention and 3D Secure. Each transaction on Tap incurs a transaction fee of 2.85% + 0.30 SAR.

3. Bayanpa

For online retailers, BayanPay offers an aggregator for payment gateways. enables business-to-business (B2B), business-to-consumer (B2C), and business-to-government payment gateway solutions (B2G). accepts a variety of payment methods, including Amex, Visa, Mastercard, Sadad, and Mada. offers options for routing payments for intrabank settlements based on the credit or debit cards of the client. offers e-wallet solutions for both individuals and companies. This app is supported by both Android and iOS operating systems and is PCI-DSS compliant.

All of the main e-commerce platforms, including Cabiri, WooCommerce, Shopify, and Astound Commerce are the e-commerce platform integrations for Bayanpay.

4. 2checkout

Another fantastic gateway, 2checkout, was established in 2006 and now has four global locations and over 17,000 clients. It is a great choice since it easily interacts with e-commerce websites, enabling companies to grow internationally and maximize recurring revenue streams through a variety of channels.

2Checkout is an international payment gateway provider that works with businesses in the United Arab Emirates and the wider Arab world. They offer an easy-to-use payment gateway that accepts a wide range of payment methods, such as digital wallets, credit and debit cards, bank transfers, and payments in several currencies. For businesses without websites, 2Checkout provides a hosted payment page. It also boasts excellent API integration services for straightforward e-commerce system integration. With 2Checkout, there are setup and monthly fees as well as a 3.5% transaction fee.

The most typical services of 2Checkout are Worldwide Payments, Online shopping, Billing for subscriptions, Analytics and reporting, and Risk control. Skrill, PO, Visa, MasterCard, Diners Club, American Express, Discover, and JCB are a few of the approved payment options for credit/debit cards. Other authorized payment methods include: Apple Pay, Google Pay, OPay, and AliPay

5. Hyperpay

In Saudi Arabia, HyperPay is a well-known supplier of payment gateways, providing dependable and safe online business payment processing. Numerous payment options are supported by the platform, including debit and credit cards as well as regional options as Mada and SADAD. Along with user-friendly features like fraud prevention and real-time transaction monitoring, HyperPay also provides an easy checkout process. Each transaction with HyperPay is subject to a 2.5% + 0.75 SAR transaction fee.

Local Payment Gateways and Increasing Business Complexities

The Saudi Arabian plague completely altered how individuals conduct business, both online and off. In response, the economy shrunk cash transactions to stop the virus from spreading.

Around the nation, startups are booming, bringing about a radical change in digital payment methods and making it possible for consumers to make online purchases of goods and services. Nonetheless, this shift is not without its difficulties; from legal barriers to the limitations of product testing to a shortage of qualified staff, these issues must be resolved for this industry to grow effectively.

In light of these significant shifts, the economy still has a long way to go before consumers feel confident enough to make online purchases.

Conclusion

Some of the greatest choices for e-commerce companies operating in the United Arab Emirates and the larger Arab world are the payment gateways in Saudi Arabia listed above. It provides several payment choices, fraud protection, and safe payment processing. In addition, it features straightforward pricing and simple interaction with e-commerce platforms. To guarantee your clients’ payments are processed quickly and securely, you must select the appropriate payment gateway for your company.

We have given you access to a variety of online payment gateways in this post that might be suitable for your target audience and line of business. You will be able to get payments from your clients in an identical amount through each gateway. The true distinction lies in the extra functionality offered, the overall portal experience, and how quickly and easily it can be integrated into your online store.

Frequently Asked Questions

Which Payment Gateway Is Best in Saudi Arabia?

With its extensive global reach, Paytabs offers a flexible payment gateway to Saudi Arabian enterprises. Tap is unique in that it offers a wide range of payment choices to accommodate different client preferences. With an emphasis on regional markets, Bayanpay provides customized solutions for companies in the area.

How Many Payment Gateway Companies Are in Saudi Arabia?

In Saudi Arabia, several payment gateway businesses provide a range of services. Notable options include PayTabs, HyperPay, Bayanpay, and Tap. Choosing the best supplier for your company will be aided by taking into account elements like transaction costs, simplicity of integration, and the range of accepted payment methods.

How Does the Integration of Saudi Arabian Payment Methods Benefit My Business?

By conforming to local tastes, integrating Saudi Arabian payment options helps your firm. Enhancing the user experience and fostering trust among customers who are accustomed to and prefer local payment methods are two benefits of this. It makes transactions easier, which lowers friction during the buying process and might lead to a rise in sales.

How Can CMARIX Help You Integrate Multiple Payment Gateway Integrations in Saudi Arabia?

In Saudi Arabia, CMARIX is a great resource for organizations looking to combine numerous payment gateways. Their knowledge guarantees a dependable and effective payment processing system, giving them a competitive advantage. By emphasizing both technical expertise and user experience, CMARIX can help you tailor your payment solutions to succeed in the Saudi Arabian market.